“Decision making requires both the situational awareness to recognize the essence of a given problem and the creative ability to devise a practical solution” 1

How to Assess Your Company’s Status

So, COVID- 19 is here and what are you – a small business owner – supposed to do?

First off, take a look at a post we wrote yesterday that addressed crisis management for times like these. Also, with so much negative news coming from all directions, it’s important to put the blinders on and focus on how to save your business.

As mentioned in previous posts, just taking a simple Assess, Decide, Act approach can help you work through the problems at hand.

Step 1. Assessing the current situation.

Before you jump in and try to assess your business, we recommend you first do a little research to learn about some of the help that was just passed in congress and signed off by the President.

Unless you’ve been asleep on another planet, then you know that a massive $2 Trillion bill was just passed which has directed billions of dollars towards small businesses. So, before beginning an assessment, you should visit the SBA website to learn what additional assistance you may qualify for.

For instance, for the current corona crisis, you can learn about specific small business assistance here. Two of those programs are listed below for easy reference.

The Economic Injury Disaster Loan (EIDL) Program

For the Economic Injury Disaster Loan program, the SBA will work directly with state Governors to provide targeted, low-interest loans to small businesses and non-profits that have been severely impacted by COVID-19.

The program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to help overcome the temporary loss of revenue you may be experiencing.

Small business owners are eligible to apply for these low-interest loans directly from the SBA and you can learn more and apply here.

SBA Express Bridge Loans

Perhaps you need cash now! If so, the SBA Express Bridge Loan Pilot Program allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork.

These loans can provide vital financial support to your small business to help overcome the temporary loss of revenue you’re experiencing.

SBA Express Bridge Loan Terms

Up to $25,000

Fast turnaround

Will be repaid in full or in part by proceeds from the EIDL loan

How to Assess the Very Small Business

With the knowledge of what new financial support you might need, you can also use a few tools that have already been created for times like this.

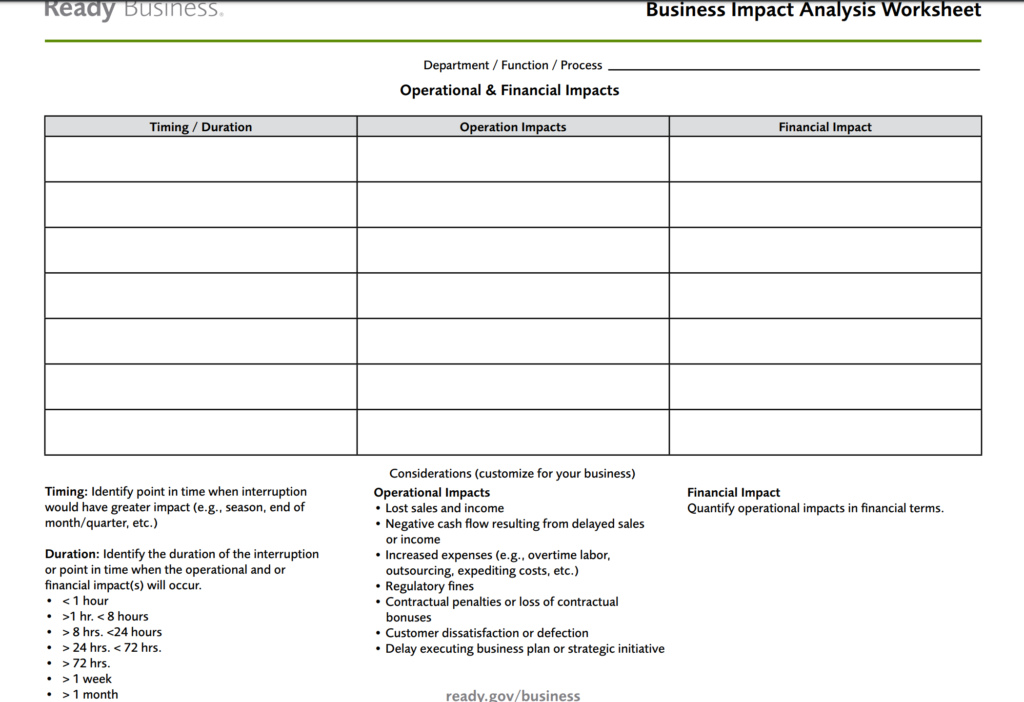

Below is a simple form that FEMA has put together and it can help you quickly organize both the operational and financial impacts the Coronavirus is having on your business. An image of the document is below but you can access the actual form here.

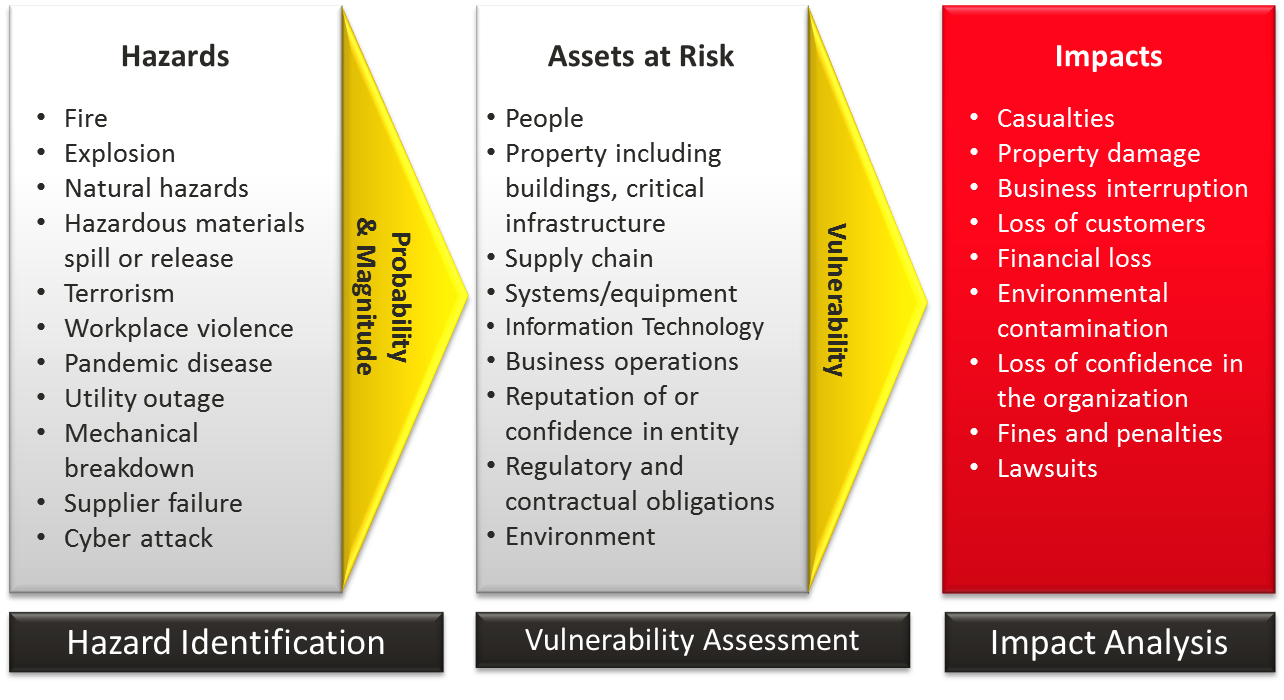

If you’re a solopreneur or owner of a very small company without many employees, this form can help you identify the vulnerabilities you might have and also help you determine your priority of effort. It will also help you build an immediate action plan that will help you get on the road to recovery.

How To Assess Larger Businesses

If you’re a more established company, you’ll need to better organize your efforts by organizing a Crisis Action Team (or CAT Team). The CAT Team approach is a way you can very quickly bring your key leaders together, assess the situation, identify essential elements of information that’s needed, and develop a plan of action for the way out of this problem.

Below is an example of a CAT Team meeting agenda that I put together for a company a number of years ago. It eventually was used by the CEO on just about every emergency they faced.

| Crisis Action Team (Meeting) | Outputs |

| 1.1 Members in Attendance | |

| CEO, President, CFO, COO, others…. | |

| 1.2 Frame the Problem | |

| 1.2.1 Identify the Need | |

| 1.2.2 Situation Brief | |

| 1.2.3 Review existing situation | |

| 1.2.4 Discuss financial impact to company (begin to discuss insurance status) | |

| 1.2.5 Define area of interest / Locations | |

| a. Location of company office/plants/assets | |

| b. ID current and past clients in Area of Interest | |

| 1.2.6 ID Key Corporate/Branch/Local Officers and Managers in impacted area | |

| 1.3 Begin Mission Analysis | |

| a. ID Main Tasks | |

| b. ID Implied Tasks | |

| c. ID Essential Tasks | |

| d. Constraints (What must we contend with that inhibits our actions | |

| e. Restraints (What we cannot do) | |

| f. Assumptions | |

| g. ID Essential Information Needed | |

| h. ID SME / Key Skills/ Potential Shortfalls | |

| i. Prioritize vs Other Engagements | |

| 1.4 Identify Potential Back Up Leaders (to replace those who get sick) | |

| 1.4.1 Corporate | |

| 1.4.2 Branch | |

| 1.4.3 Local | |

| 1.5 Identify Possible Information Requirement’s | |

| 1.5.1 Key Items to review/consider | |

| a. Review previously built COOP plans | |

| b. Review financial status and capital usage rates. | |

| c. Review Insurance coverage. | |

| d. Get and maintain updates on impact to staffing and operations. | |

| e. What impact is there on our supply chain and service providers. | |

| f. What is the status of existing customers and how can you help. | |

| 1.5 Begin Rough Timeline | |

| 1.6 CEO Provides Guidance on: | |

| 1.6.1 CEO Orientation as he sees things | |

| a. Overall Intent / Guidance | |

| b. Specific Action Items Wanted | |

| c. Priorities | |

| d. ID Focus of Effort | |

| e. Guidance on Team Organization | |

| f. Issue Warning Order to Staff or Not | |

| g. ID Date and Time for Next Meeting |

The items listed above aren’t meant too cover all functional area’s but instead are meant to be a starting point for businesses to begin their recovery. You can easily add other important area’s like IT, sales and marketing, inventory, etc.. The bottom line is, if you haven’t already begun planning for recovery, you should get started right away as the longer it takes you to get going, the longer you’ll miss that badly needed revenue as well as leave an opportunity for someone else to step in and take your hard earned customers.

Hopefully, you’ve found this post helpful. The next post will address the Decision portion of our Assess, Decide, Act approach.

Contact us if you need help getting through this crisis. We assist companies of all sizes and once you see our SMART rates, you’ll feel much better.

Phone: (646) 883-2927

Email: [email protected]

Web: https://ridgebackbusinesssolutions.com/

- Quote from Major John D. Jordan USMC – “Wanted: Critical Thinkers+